Comprehending American Hartford Gold

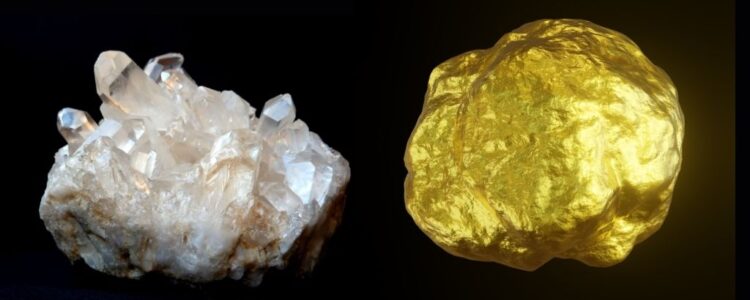

American Hartford Gold Reviews Reddit is a popular company of rare-earth elements, concentrating on gold and silver financial investments. With a dedication to openness and integrity, the firm intends to equip investors with the devices and sources needed to navigate the intricacies of the market efficiently. Founded on concepts of integrity and depend on, American Hartford Gold has developed itself as a trusted partner for individuals looking for to protect their financial futures.

Revealing The Fact

The journey of discovering the truth behind American Hartford Gold starts with an exploration of the testimonials that have actually formed public assumption. While evaluations act as valuable insights right into the experiences of others, it is necessary to approach them with a critical eye, taking into consideration variables such as credibility, context, and prejudice.

Credibility

When assessing reviews of American Hartford Gold, it is vital to consider the integrity of the source. Seek testimonials from trustworthy banks, independent analysts, or validated customers that have direct experience with the firm’s solutions. By prioritizing reputable resources, you can acquire a much more exact understanding of American Hartford Gold’s performance and reputation.

Context

Context plays a crucial duty in interpreting reviews of American Hartford Gold. Elements such as market conditions, financial trends, and specific investment goals can considerably affect the regarded value of the company’s services. Take into consideration the more comprehensive context in which evaluations are provided to gain a more nuanced perspective on American Hartford Gold’s performance about dominating problems.

Predisposition

Similar to any evaluation, prejudice can influence the representation of American Hartford Gold’s offerings. Bear in mind evaluations that display overt predisposition, whether positive or adverse, as they might not give an objective evaluation of the firm’s toughness and weak points. Strive to seek out well balanced perspectives that evaluate both the advantages and downsides of investing with American Hartford Gold.

Revealing The Verdict

After mindful factor to consider of testimonials, it becomes apparent that American Hartford Gold has gathered a predominantly favorable reputation within the investment area. Consumers applaud the firm for its transparency, dependability, and dedication to customer contentment. Additionally, American Hartford Gold’s focus on education and individualized service reverberates with investors seeking a partner they can trust.

Nevertheless, it is important to recognize that no financial investment possibility lacks its risks. While American Hartford Gold supplies a protected opportunity for branching out portfolios and hedging against financial uncertainty, financiers need to weigh the potential benefits versus the fundamental volatility of the rare-earth elements market.

The Importance Of Unbiased Reviews

In a period controlled by on-line info and ads, distinguishing between biased and impartial evaluations can be tough. Prejudiced reviews commonly offer the rate of interests of the business or private advertising a specific product and services, while honest evaluations aim to offer unbiased understandings based upon realities and evaluation. When it concerns monetary choices, depending on objective reviews is critical to guarantee that you’re getting exact info and making informed options that line up with your economic objectives.

Deciphering The Reality: Honest American Hartford Gold Reviews

Now, allow’s look into the world of unbiased American Hartford Gold examines. These testimonials are carried out by independent financial experts and consumers that have direct experience with the company’s product or services. They intend to offer an objective evaluation of American Hartford Gold, shedding light on its toughness, weak points, and overall worth proposal.

Transparency and Credibility: One of the crucial elements assessed in unbiased evaluations is the openness and credibility of American Hartford Gold. This includes analyzing aspects such as costs, rates, customer care, and the company’s record. Objective reviewers explore the business’s background, client reviews, and regulative conformity to determine its credibility.

Item Offerings: An additional crucial element checked out in impartial testimonials is the array and quality of American Hartford Gold’s product offerings. Reviewers assess the variety of gold and silver products offered, their pureness, liquidity, and storage space options. They also analyze whether the items used by American Hartford Gold align with the diversification and danger reduction goals of investors.

Customer Experience: The customer experience plays a significant function fit impartial reviews of American Hartford Gold. Customers examine elements such as convenience of account arrangement, responsiveness of customer assistance, and general complete satisfaction levels reported by existing customers. They also consider any type of complaints or issues increased by clients concerning their communications with the firm.

Investment Efficiency: Eventually, unbiased testimonials seek to analyze the financial investment performance of American Hartford Gold’s products. Reviewers evaluate historical efficiency data, market trends, and specialist point of views to establish the potential returns and dangers related to buying gold and silver with American Hartford Gold. They also consider elements such as inflation hedging capacities and profile diversification benefits.

Deciphering The Reviews: Separating Reality From Fiction

Similar to any investment opportunity, American Hartford Gold has actually amassed a mix of evaluations from financiers and market specialists alike. Some hail it as a trusted method to diversify one’s portfolio and hedge versus market volatility, while others share issues concerning concealed costs and deceptive marketing methods. Let’s take a better look at several of the common styles that arise from these reviews.

Favorable Reviews

Diversification Advantages: Many financiers praise American Hartford Gold for its ability to offer true portfolio diversity. By including silver and gold to their financial investment mix, people can minimize their total threat direct exposure and protect their wealth against changes in the stock exchange.

Excellent Customer Support: A persisting theme in favorable evaluations is the exceptional level of client service offered by American Hartford Gold. Capitalists appreciate the customized attention and expert advice provided by the business’s reps, that are easily available to resolve their inquiries and issues.

Openness and Reliability: A number of reviewers applaud American Hartford Gold for its openness and sincerity in conducting service. Unlike some other precious metals suppliers, American Hartford Gold is recognized for providing clear and simple details about rates, costs, and financial investment choices, instilling confidence in its consumers.

Unfavorable Testimonials

High Costs: One of one of the most usual objections leveled versus American Hartford Gold is the presence of high charges related to its solutions. Some financiers complain concerning concealed fees and management prices that eat into their returns, making it tough to accomplish meaningful development in their investments.

Marketing Strategies: A few customers reveal uncertainty regarding American Hartford Gold’s marketing methods, affirming that the company uses fear-based marketing to draw in consumers. While there is indisputable merit in branching out into precious metals, doubters say that American Hartford Gold might overemphasize the risks of conventional financial investments to push its own program.

Limited Investment Options: Regardless of supplying a variety of financial investment items, some financiers feel that American Hartford Gold’s choices are relatively limited contrasted to other precious metals dealerships. This lack of selection can be a deterrent for individuals looking for more specific or adjustable investment services.

Verdict

Finally, the testimonials bordering American Hartford Gold give useful insights into the business’s credibility and efficiency. By coming close to evaluations with a crucial mindset and considering aspects such as integrity, context, and predisposition, investors can make enlightened choices regarding whether American Hartford Gold aligns with their investment purposes.

Ultimately, American Hartford Gold stands as a sign of stability in an ever-changing economic landscape, supplying individuals the chance to secure their riches through precious metals investments. As investors remain to seek haven from market volatility, American Hartford Gold continues to be a trusted partner, unveiling the reality behind its credibility one testimonial at once.